CJ Follini, Publisher

Table of Contents

Welcome back, Noyackers!

Tariffs. The word alone sounds like it belongs in a dusty Econ 101 textbook or a politician’s stump speech. But if you’ve ever noticed the cost of your go-to sneakers jumping or wondered why your tech gear is suddenly pricier, you’ve felt the ripple effects firsthand.

This week, we’re demystifying tariffs—what they are, what’s new in 2025, and why you should be paying attention.

Let’s go.

⚖️ What’s a Tariff Anyway?

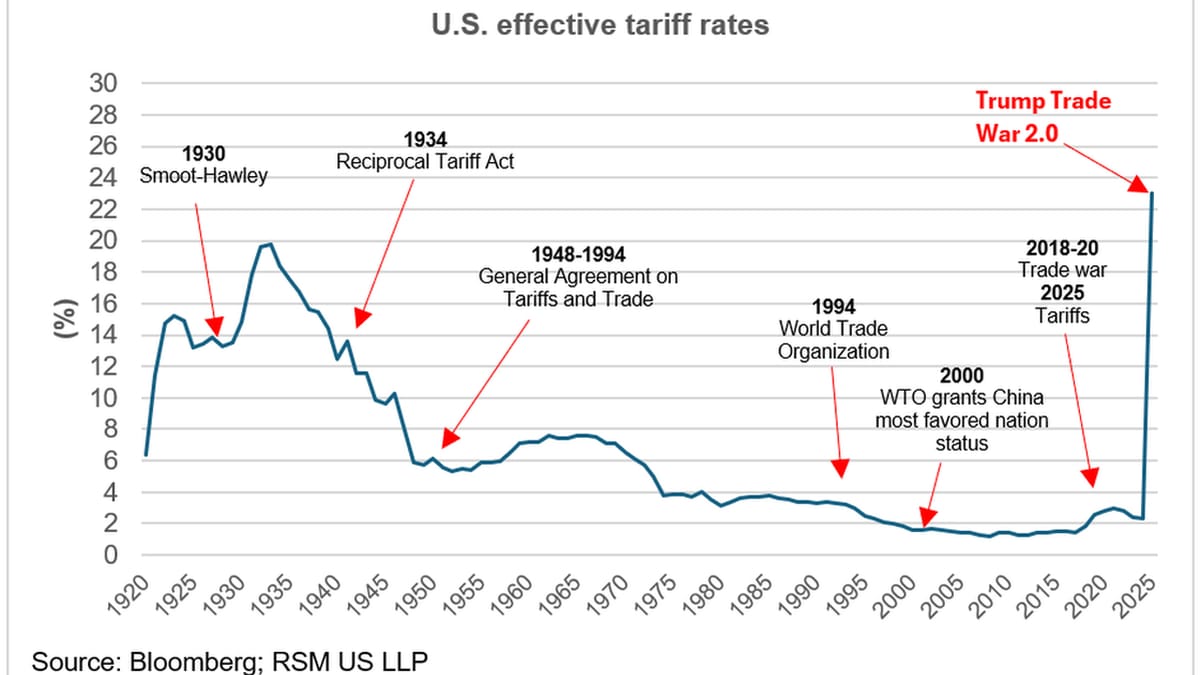

At its core, a tariff is a tax on imported goods. Governments impose them to make foreign products more expensive, hoping you'll buy domestic instead.

But tariffs aren’t just about economics. They’re weapons in trade wars, bargaining chips in global negotiations, and yes, a sneaky way to drive up the cost of everything from iPhones to avocados.

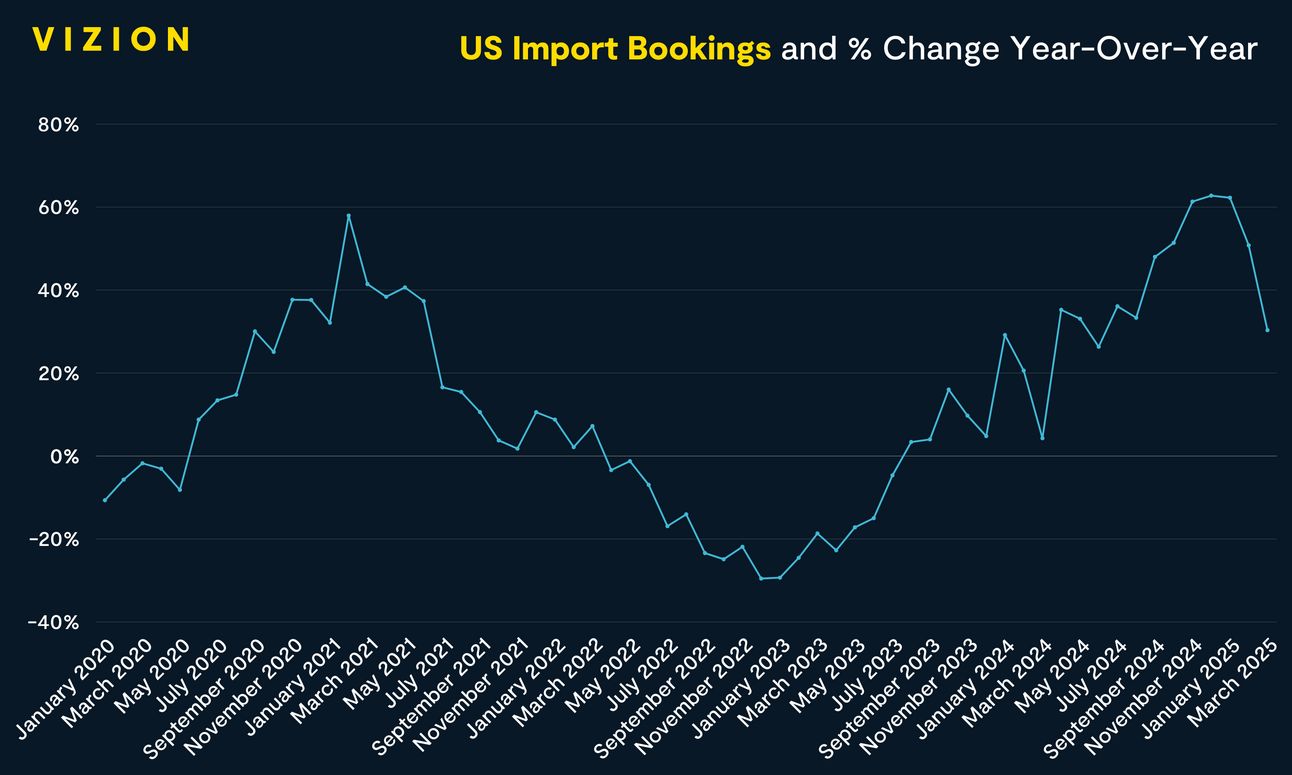

The 2025 Twist: Reciprocal Tariffs

This year, the U.S. rolled out reciprocal tariffs—essentially saying, "If you tax our goods, we’ll match it." Countries like China, Vietnam, and even our trading buddies in the EU have been hit with duties as high as 49%.

For example:

China: 104% effective tariff

Vietnam: 46%

Japan & EU: 20–24%

Why? The U.S. is targeting trade partners with big surpluses or higher tariffs on American goods. In theory, it’s about fairness. In reality? Higher prices for us.

The Real Cost to You

Let’s break it down like a personal finance nerd at brunch:

🛍️ Higher Prices for… Well, Everything

From fashion to food, electronics to furniture—if it’s made overseas, tariffs make it pricier. That $1,000 laptop might now cost $1,100. Not cute.

🧃 Inflation Booster Shot

Tariffs don’t just tax the other guy. They fuel inflation right here at home, pushing up prices across the board.

📉 Investment Red Flags

Tariff-fueled uncertainty? It messes with markets. Add that to rate hikes and political volatility, and it's harder for investors (ahem, like you) to plan long-term.

⚒️ Job Creation… Not So Fast

While tariffs aim to protect U.S. jobs, history shows they rarely work as advertised. Remember the steel tariffs from 2018? They helped steelmakers but hurt auto and manufacturing jobs downstream.

👛 Regressive Impact

Low and middle-income Americans—aka many Millennials and Gen Z—get hit hardest. When your disposable income’s already stretched, a 10% hike on essentials isn’t minor.

🎯 So Why Use Tariffs at All?

They look good politically, especially in an election year. They can also act as bargaining tools to pressure other countries to open their markets.

But let’s be real: They’re blunt instruments—more hammer than scalpel.

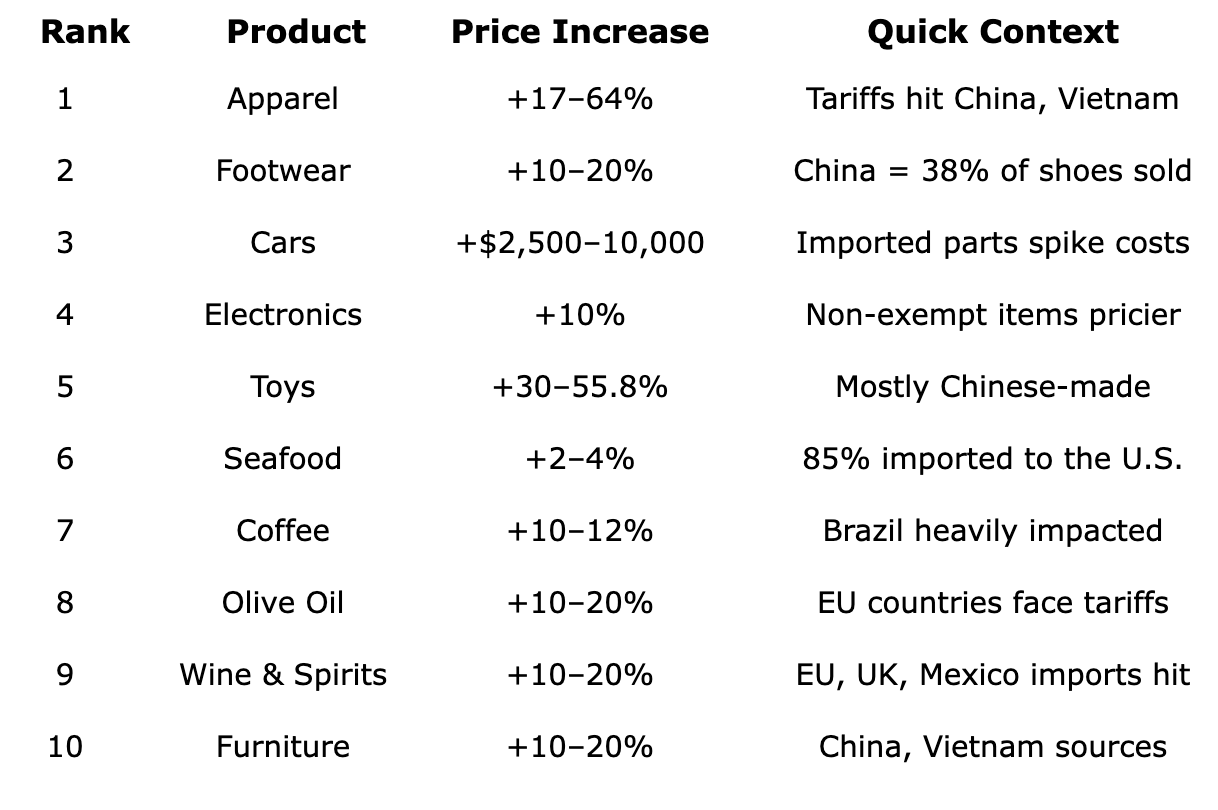

What’s Getting More Expensive? Here’s Your Tariff Hit List

Yes, tariffs are abstract. But here’s how they’ll show up in your Venmo, cart, and monthly budget.

Based on 2025 policy and economic models from Yale, the National Retail Federation, and others, these everyday items are likely to get hit hardest by new U.S. tariffs, along with estimated price hikes.

💡 Note: These are short-term estimates based on economic modeling. Actual increases may vary based on how companies adjust supply chains—or whether they pass costs to consumers (spoiler: they usually do).

🎙️ On the Podcast This Week

CJ breaks down the politics behind reciprocal tariffs, why Gen Z is right to be skeptical, and how investors can future-proof their strategy in our latest episode.

💡Actionable Tips

Diversify Globally – Tariffs might hurt one country but boost another. A globally balanced portfolio spreads the risk. Also, real estate, real estate, real estate.

Watch Retail & Manufacturing Stocks – These sectors get hit hard in tariff wars.

Follow Policy, Not Just Headlines – Tariffs change fast. Subscribe to global trade policy trackers (we love the Peterson Institute).

Budget for Higher Prices – Especially if you love imported goods. (We see you, techies and sneakerheads.)

Vote with Your Dollars – Support brands with transparent supply chains and local sourcing.

Review your playbook regularly—and stick to it.

Want us to decode a policy for you? Email us at [email protected].

Til next Sunday,

CJ & The NOYACK Team

Access Granted™