Est. Reading Time: 5 min

Table of Contents

📣 MASTERCLASS ALERT 📣

On to this week’s topic - Intro to all things Bitcoin. But before we begin we’d like to tease our Masterclass newsletter series on everything you need to know about Digital Assets so you know where we’re headed (just like our series on Estate Planning - returning soon). We will drop one of the sections below every 4 weeks or so.

If you have any suggestions or comments, hit us up at [email protected] and let us know what you're thinking; this is a dialogue not a lecture. We want to learn together to win together.

Today - Bitcoin: The Origin, Evolution, and Impact on the Financial Landscape

Ethereum and the Rise of Decentralized Applications (DApps)

Investing in Cryptocurrencies: Navigating the Market, Risks, and Strategies

The Mechanics of Cryptocurrencies: Mining, Halving, and the Role of Blockchain

Altcoins, Tokens, and the Expanding Cryptocurrency Ecosystem

The Fascinating World of Non-Fungible Tokens (NFTs): Art, Collectibles, and Ownership Redefined

Tokenizing Real-World Assets: The Future of Real Estate and Financial Instruments

Navigating the Regulatory Landscape and the Future of Digital Assets

Bitcoin: The Origin, Evolution, and Impact on the Financial Landscape

The Birth of Bitcoin

In 2008, amidst a global financial crisis that shook confidence in traditional banking systems and government-issued currencies, an individual or group under the pseudonym Satoshi Nakamoto published a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This document laid the groundwork for Bitcoin, the world's first cryptocurrency. At its core, Bitcoin was conceived as a decentralized digital currency that could facilitate transactions without the need for intermediaries like banks or governments.

How Bitcoin Works

Bitcoin operates on a technology called blockchain, a decentralized ledger that records all transactions across a network of computers. This ensures transparency and security, as each transaction is verified by multiple participants in the network and then encrypted. The process of verifying transactions, known as mining, also introduces new bitcoins into the system, capped at a total of 21 million to prevent inflation.

Evolution and Growth

This evolution can be dissected into several key phases:

Early Adoption: Initially, Bitcoin was the domain of tech enthusiasts and libertarians who appreciated its decentralization and anonymity. Its use in transactions, especially in niche online markets, demonstrated its practical value beyond mere speculation.

Mainstream Attention: As Bitcoin's value began to rise, it caught the attention of a broader audience, including investors, speculators, and the media. This phase was marked by volatile price swings, high-profile thefts from exchanges, and growing scrutiny from regulators.

Maturation: Over time, the infrastructure surrounding Bitcoin became more robust, with improved security features, more user-friendly wallets, and the emergence of regulated exchanges. Institutional investors started to take notice, and Bitcoin's narrative began to shift from a purely speculative asset to a potential hedge against inflation and a "digital gold."

Innovation and Diversification: The technology underlying Bitcoin, blockchain, found applications beyond cryptocurrencies. Projects exploring decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts proliferated, indicating the technology's potential to revolutionize various sectors.

Impact on the Financial Landscape

Bitcoin, often likened to "digital gold," emerged in 2009, revolutionizing how we view and use money. Created by an unknown person or group named Satoshi Nakamoto, this digital currency operates without the need for banks or government oversight, marking a significant departure from traditional financial systems.

A New Kind of Investment - Bitcoin has created a new asset class, attracting both individual investors drawn to its potential for high returns and institutional investors looking for ways to diversify their portfolios. Its unique characteristics offer a fresh approach to investing, unlinked to the ups and downs of traditional stock and bond markets.

Broadening Financial Access - One of Bitcoin's key achievements is making financial transactions possible across the globe without the need for a traditional bank account. This is especially vital in places where banking facilities are scarce, offering a lifeline to economic participation and empowerment for people in developing regions.

Setting New Rules - The rise of Bitcoin has pushed regulators worldwide to rethink their approach to digital assets, balancing the need to protect consumers with the desire to encourage financial innovation. These ongoing discussions are shaping how cryptocurrencies fit into the broader financial landscape.

Inspiring Innovation - Bitcoin's backbone, blockchain technology, has led to groundbreaking developments in financial services. From making payments to securing loans, blockchain is making these processes more efficient and transparent, challenging conventional banking practices.

Redefining Banking - Perhaps most intriguing is how Bitcoin is shaking up the traditional banking sector. It offers an alternative to nearly every service banks provide, from simple transactions to loans, without the need for a central controlling authority. This poses a significant challenge to banks, forcing them to innovate or risk becoming obsolete. For consumers, this means more choices and potentially lower costs. As banks and other financial institutions grapple with these changes, we may see a shift towards more decentralized and user-focused financial services.

Institutional Investors Are Here To Stay: The Game-Changing Impact of Bitcoin ETFs

The landscape of cryptocurrency investment has witnessed a seismic shift with the introduction of Spot Bitcoin Exchange-Traded Funds (ETFs), marking a new era where institutional investors are cementing their presence in the digital asset space. This movement is underscored by the meteoric rise in Bitcoin's value, closely linked to the unprecedented inflows into these newly approved financial instruments.

The price of Bitcoin is now up a staggering 121% over the past year.

The Catalyst of Growth 🚀

On March 1st, a landmark moment was achieved by BlackRock’s iShares Bitcoin Trust, which became the inaugural Spot Bitcoin ETF to amass over $10 billion in assets under management (AUM), accomplishing this feat a mere seven weeks post-listing. This milestone is particularly noteworthy when juxtaposed with the trajectory of their flagship Gold ETF, which took more than two years to reach the same level of AUM. Such rapid accumulation not only highlights the growing appetite for digital assets among institutional investors but also signals a broader acceptance of cryptocurrencies as a legitimate asset class.

Gold vs. Bitcoin: Which One Protects Us Better Against Inflation

As we stand at the crossroads of an evolving financial landscape, the age-old question of how best to protect our wealth against the erosion of inflation takes on new dimensions. With the advent of Bitcoin ETFs and their comparison to the long-trusted Gold ETFs, investors, especially those new to the crypto space, are pondering: In the face of inflation, which is the better guardian of our purchasing power—gold or Bitcoin?

The Traditional Bastion: Gold

Gold has long been the standard-bearer for hedging against inflation. Its tangible value, finite supply, and historical precedent as a store of wealth have made it a go-to asset for investors looking to safeguard their portfolios. The launch of Gold ETFs provided a modern avenue for investment, making gold more accessible and further cementing its role as a financial safe haven.

At the core of Bitcoin's appeal as a hedge against inflation lies its scarcity and decentralized nature. Unlike fiat currencies, which can be endlessly printed by central banks, Bitcoin has a fixed supply cap of 21 million coins. This inherent scarcity, coupled with the increasing demand for a digital store of value, has positioned Bitcoin as a compelling hedge against the erosive effects of inflation.

A Comparative Look

The rapid asset accumulation seen with the introduction of Bitcoin ETFs dwarfs the early days of Gold ETFs, suggesting a growing confidence in Bitcoin's role within the investment landscape. This isn't merely about numbers; it's a signal of shifting investor sentiment towards viewing Bitcoin as a viable, perhaps even superior, alternative to gold in the quest to mitigate inflation's impact.

In late February, Bloomberg ETF analyst Eric Balchunas said, “Gold’s pain is Bitcoin ETFs’ gain in the store of value smackdown.” He added that there was a “decent chance” that Bitcoin ETFs would surpass gold ETFs in AUM in less than two years.

Understanding Market Dynamics

Bitcoin's scarcity is amplified by the mechanics of Bitcoin ETFs, which reduce the available supply by locking up Bitcoin to back the funds. This scarcity, combined with Bitcoin's global reach and the ease of digital transactions, positions it uniquely as an inflation hedge. Unlike gold, which has diverse uses and holdings patterns, Bitcoin's tightly held supply and the digital enthusiasm surrounding it could lead to more pronounced price appreciation in the face of inflationary pressures.

The Bitcoin Halving is Only ~29 Days Away

Another key driver of the recent rally, is the fact that the next BTC halving is expected a little over a month from now - on or around April 20th.

So what exactly is Bitcoin halving? Check out this great explainer vid from Coingecko:

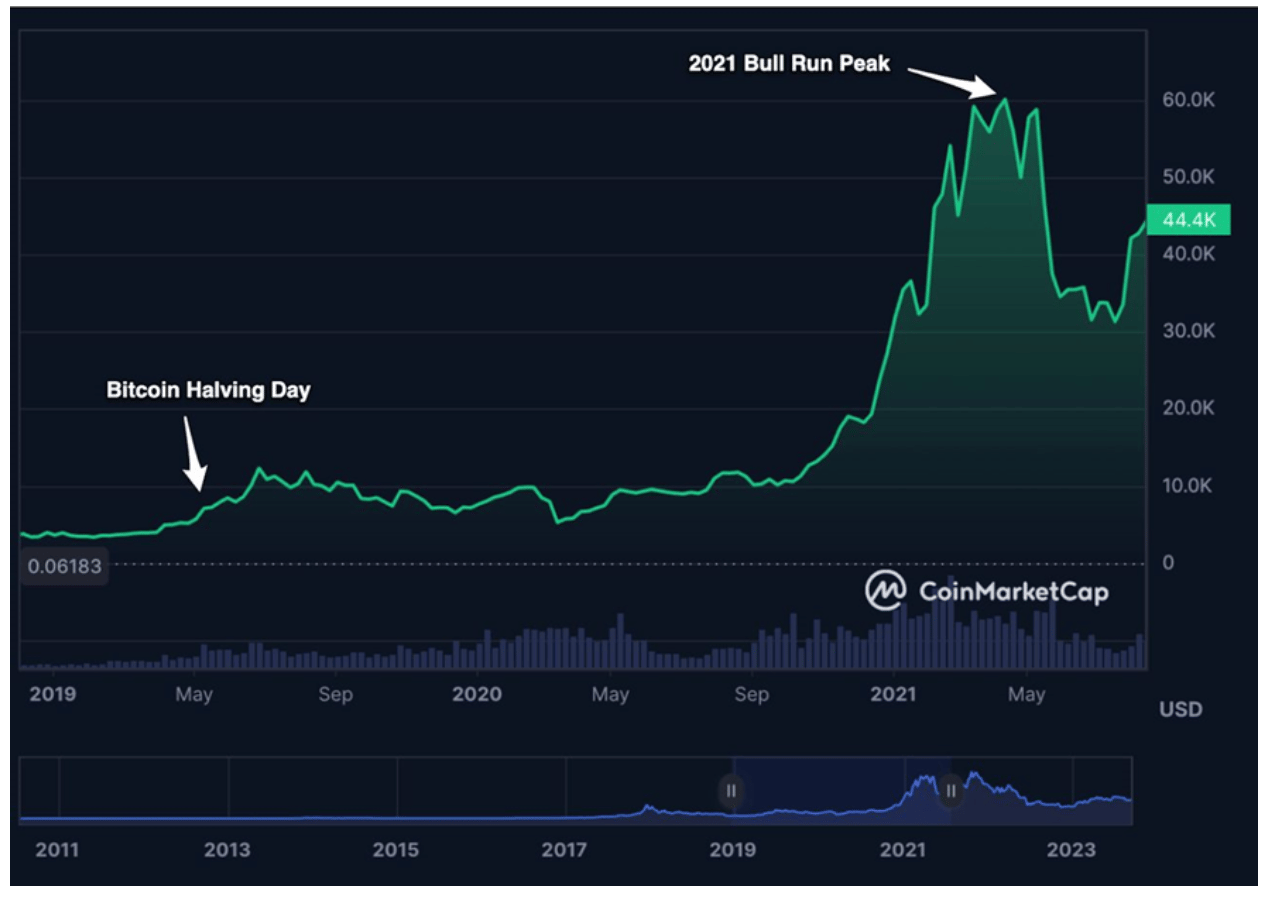

This leads to an even bigger supply crunch, and has historically the halving has led to higher crypto prices across the board. See the chart below highlighting the May 11th, 2020 halving below ….

Final Thoughts

Wrapping up, let's think about Bitcoin ETFs as a game-changer for folks looking to keep their money safe from inflation's bite. It's like we're stepping into a new chapter of investing, where Bitcoin shines as a cool option against the usual ways of protecting our cash, like gold. For those of us just starting out on our investment journey, this opens up an exciting path to explore something fresh and digital, giving us a handy tool against the ups and downs of the economy. Stay tuned for more chapters in our Digital Assets series this year.

Curated For You

STUFF TO DO WITH NOYACK

Read past editions here

Noyack Wealth Weekly is the leading wealth management newsletter published by CJ Follini & Noyack Wealth Club, a nonprofit dedicated to free financial literacy for younger generations. Feel free to tell us what you think of our little newsletter.