CJ Follini, Publisher

Good morning, Noyackers!

Retirement planning doesn’t have to mean riding the stock market rollercoaster or dealing with the headaches of owning rental properties. If you’re looking for a passive, tax-advantaged way to invest in real estate, Real Estate Investment Trusts (REITs) inside a Self-Directed IRA (SDIRA) might be the missing piece of your long-term wealth strategy.

With REITs, you can own a piece of income-generating real estate without managing tenants, handling maintenance, or making large upfront capital commitments. And when you invest through a Self-Directed IRA, you maximize tax efficiency, allowing your money to grow tax-free or tax-deferred.

Let’s break it down. 👇

Would you invest in REITs?

🏡 What Are REITs and Why Should You Care?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing properties. By investing in REITs, you gain exposure to residential, commercial, industrial, and healthcare real estate—without needing to buy and manage properties yourself.

Key Benefits of REITs:

Steady Passive Income – REITs must distribute at least 90% of taxable income as dividends.

No Landlord Responsibilities – No tenant issues, maintenance costs, or direct property management.

Diversification & Stability – REITs invest in multiple real estate sectors, reducing risk compared to owning a single property.

Liquidity & Flexibility – Unlike physical real estate, publicly traded REITs can be easily bought and sold.

But the biggest advantage comes when you hold REITs inside a Self-Directed IRA, which unlocks substantial tax benefits for long-term investors.

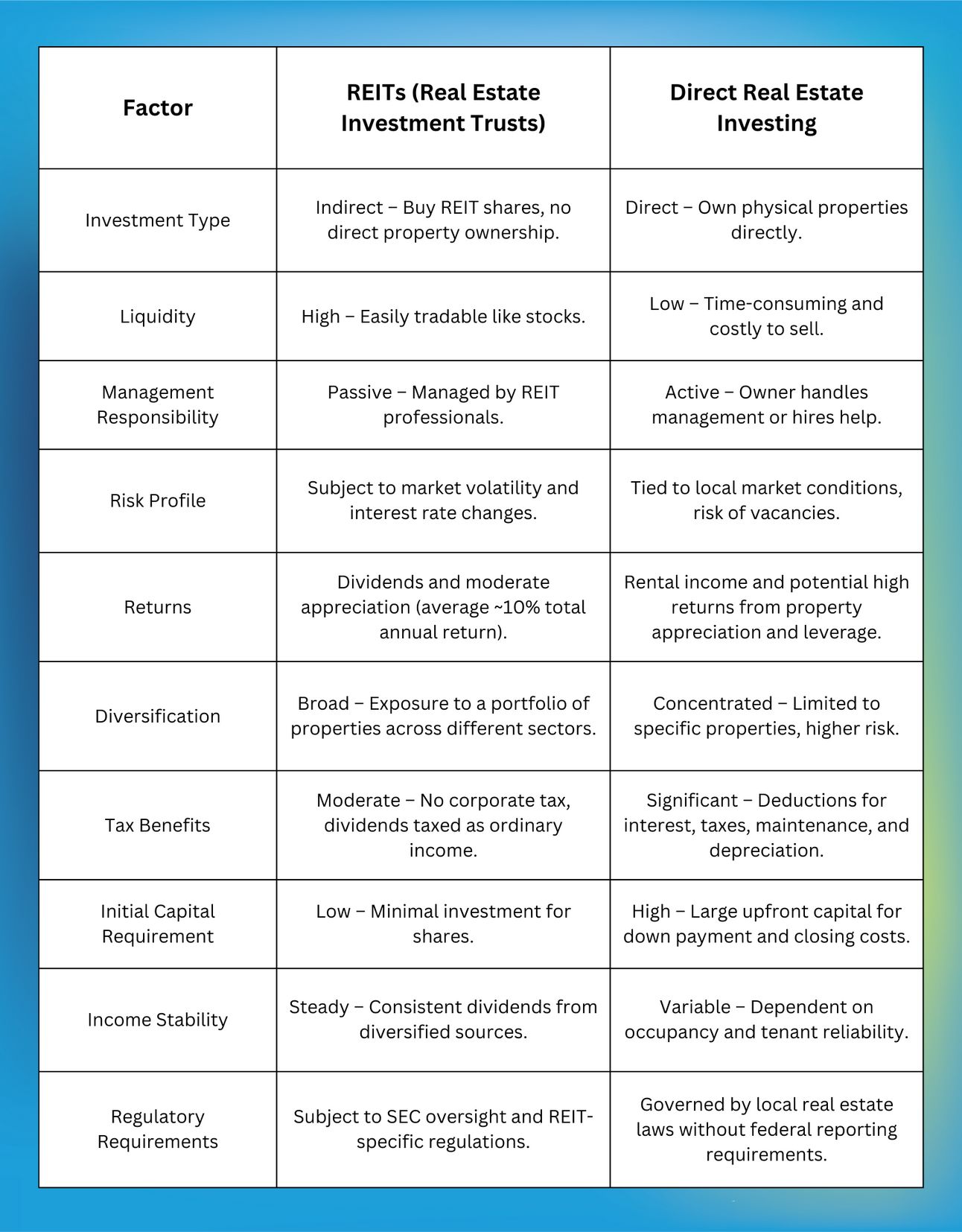

🛠️ REITs vs. Direct Real Estate Investing: Which is Better for Retirement?

Many investors assume that owning rental properties is the best way to build wealth in real estate. While direct real estate investing has its advantages, it also comes with high costs, market fluctuations, and ongoing management.

Direct Real Estate Investing

📌 Pros: Full control, ability to leverage mortgages, potential tax deductions.

📌 Cons: Requires significant upfront capital, illiquid, market-dependent, ongoing management required.

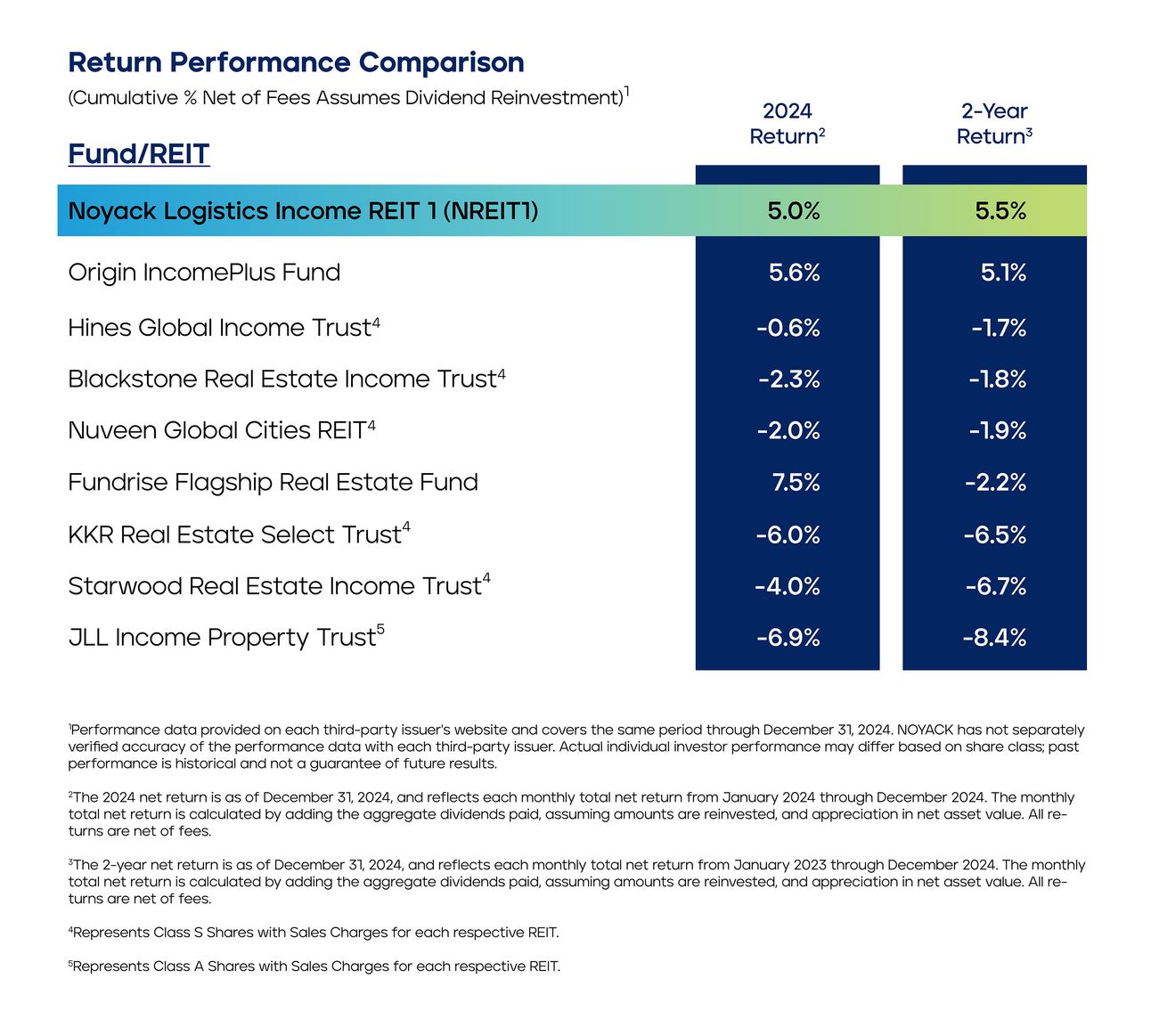

REITs vs. Direct Real Estate Investing Comparison Table

💰 Why Invest in REITs for Retirement? (Especially in a Self-Directed IRA)

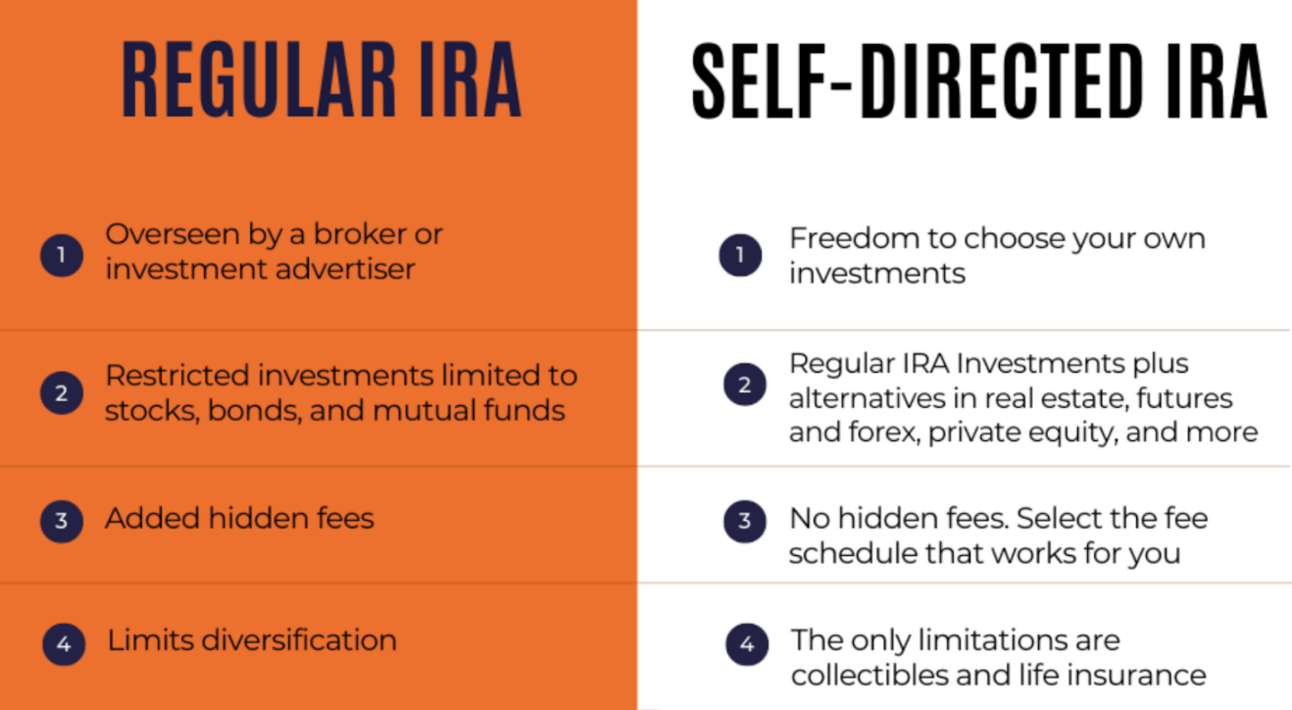

A Self-Directed IRA (SDIRA) allows you to invest in alternative assets beyond stocks and bonds, including REITs, private real estate funds, and other non-traditional investments.

📈 REITs in a Self-Directed IRA

📌 Pros: Low-cost entry, tax advantages, fully passive, diversified real estate exposure.

📌 Cons: No direct control, market fluctuations (for publicly traded REITs).

For investors who want real estate exposure without the hands-on work, REITs—especially non-traded REITs in an SDIRA—provide a hassle-free solution with built-in diversification and tax efficiency.

Why Consider REITs in a Self-Directed IRA?

Tax-Free or Tax-Deferred Growth – In a Roth SDIRA, your REIT dividends and capital gains grow tax-free forever. In a Traditional SDIRA, you defer taxes until withdrawal.

Reliable Retirement Income – The consistent dividends from REITs can act as a steady cash flow source in retirement.

Diversification Beyond Stocks & Bonds – Real estate-backed investments provide stability in volatile market cycles.

🏦 Types of REITs to Consider in an SDIRA

Not all REITs are the same. Here’s how they compare:

Publicly Traded REITs – Bought and sold like stocks, offering liquidity but also subject to market fluctuations.

Non-Traded REITs – Not listed on exchanges, offering higher dividend yields but requiring longer holding periods.

Private REITs – Available only to accredited investors, often with higher return potential but less transparency.

For long-term retirement investors, non-traded REITs offer a balance of stability and higher potential yields, making them an attractive choice for steady, passive income.

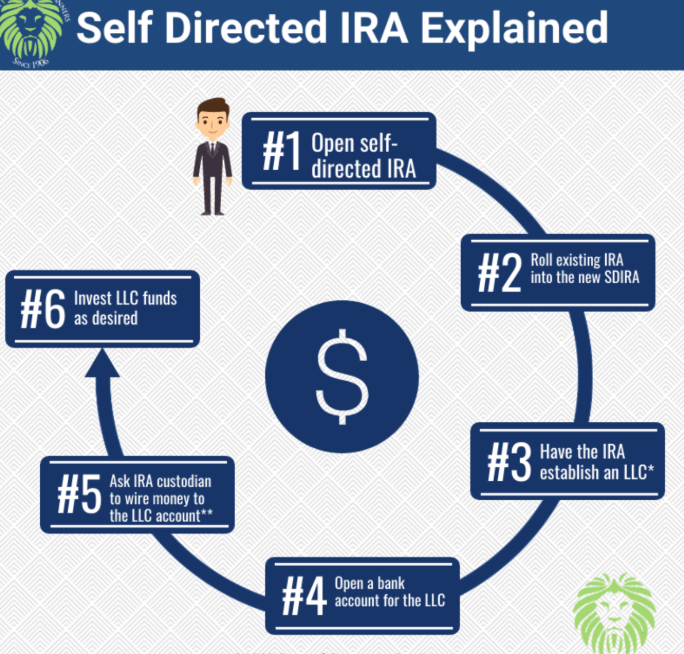

📊 How to Get Started with REITs in a Self-Directed IRA

Open a Self-Directed IRA – Work with an SDIRA custodian that allows alternative assets (not all brokerages offer this).

Fund Your Account – You can roll over an existing IRA or 401(k) or make new contributions within IRS limits.

Choose the Right REIT for Your Goals – Decide whether you prefer publicly traded, non-traded, or private REITs based on your investment strategy.

Invest & Monitor – REITs are mostly passive, but periodic reviews ensure they align with your retirement goals.

🚀 The Smart, Passive Way to Build Retirement Wealth

For Millennials and high-income earners looking for a hands-off, tax-efficient way to invest in real estate, REITs inside a Self-Directed IRA offer one of the best solutions.

If you want real estate exposure without the landlord stress, REITs are a perfect fit.

If you want tax-free retirement growth, a Roth SDIRA makes it possible.

If you want steady, hands-off income, non-traded REITs can be a great addition.

Thinking about adding REITs to your retirement portfolio? Let us know—we’d love to hear your thoughts!