Est. Reading Time: 5 min

Table of Contents

What IS Inflation?

Hey there, finance newbies and savvy savers of Gen Z and Millennials! Let's dive into a simpler breakdown of some inflation insights since the year 2000, tailored just for you.

Inflation is like a couch-surfing friend who won't take the hint… it's always around, sometimes more noticeable than others, and can really start to affect your daily life if you don't manage it properly. In this edition, we'll dive into how inflation has shaped the landscape of personal finance since 2000, exploring the fastest runners and the deflation exceptions, and offering insights into navigating these financial waves with savvy and foresight.

Deciphering the CPI: The Inflation Weather Report

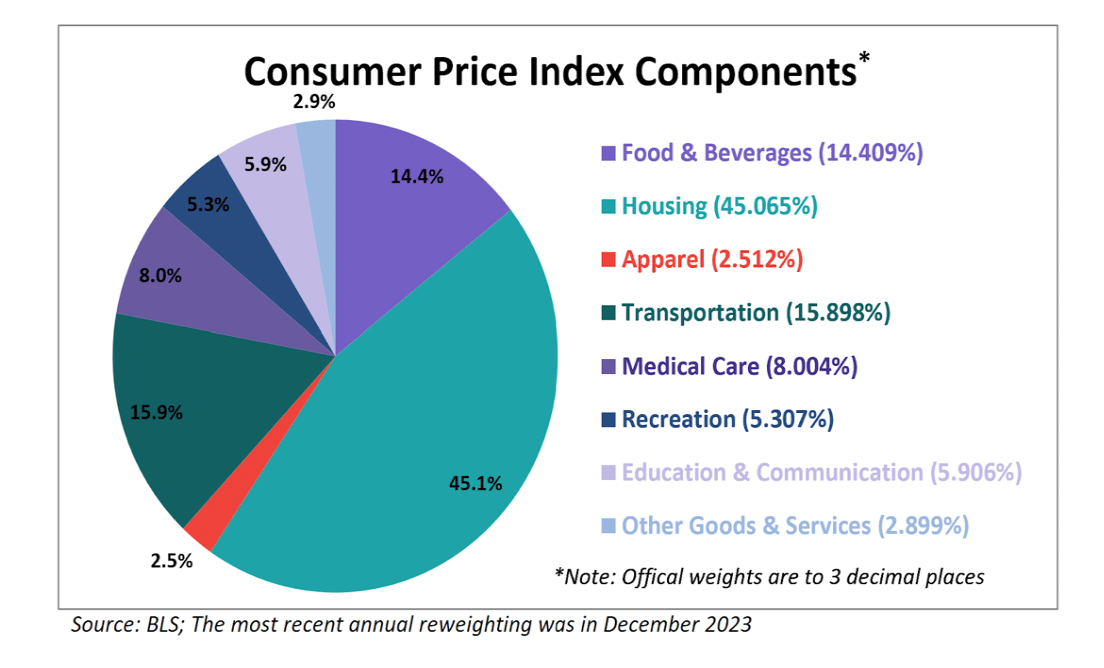

Ever heard of the Consumer Price Index (CPI)? Think of it as the weather report for inflation. It measures the average change in prices over time for a basket of goods and services – you know, stuff like groceries, rent, and gas. When the CPI goes up, inflation's on the rise, and your purchasing power takes a hit. So, keep an eye on that CPI like a hawk!

The first three follow the traditional order of urgency: food, shelter, and clothing. Transportation comes before Medical Care, and Recreation precedes the lumped category of Education and Communication. Other Goods and Services refers to a bizarre grab-bag of odd fellows, including tobacco, cosmetics, financial services, and funeral expenses. For a complete breakdown and relative weights of all the subcategories of the eight categories, here is a useful link.

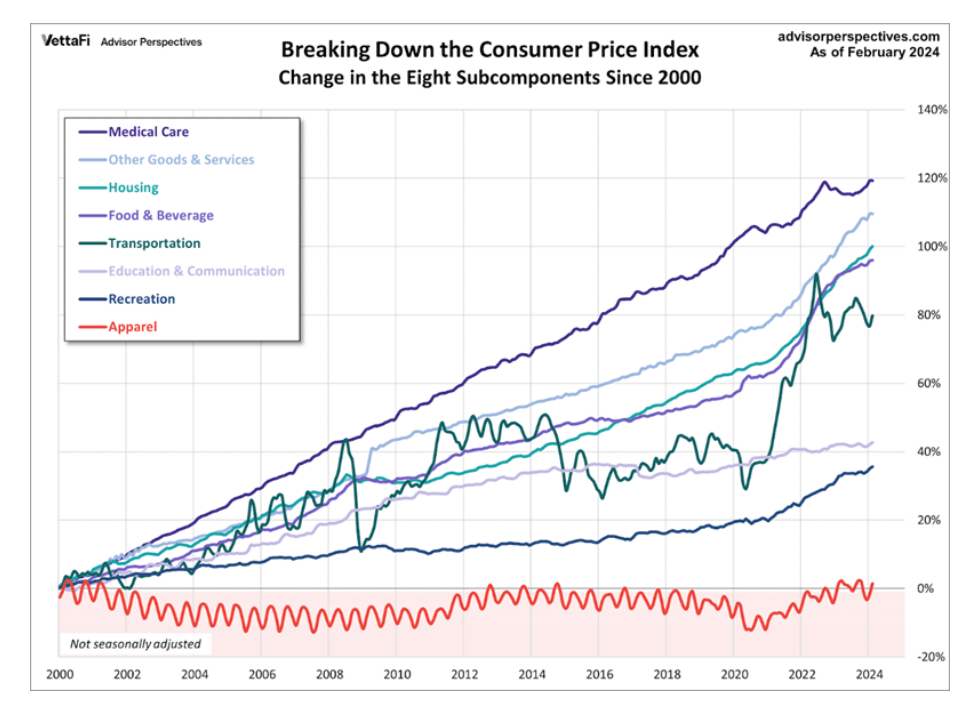

The chart below shows the cumulative percent change in price for each of the eight categories since 2000.

The 8 Components of the CPI

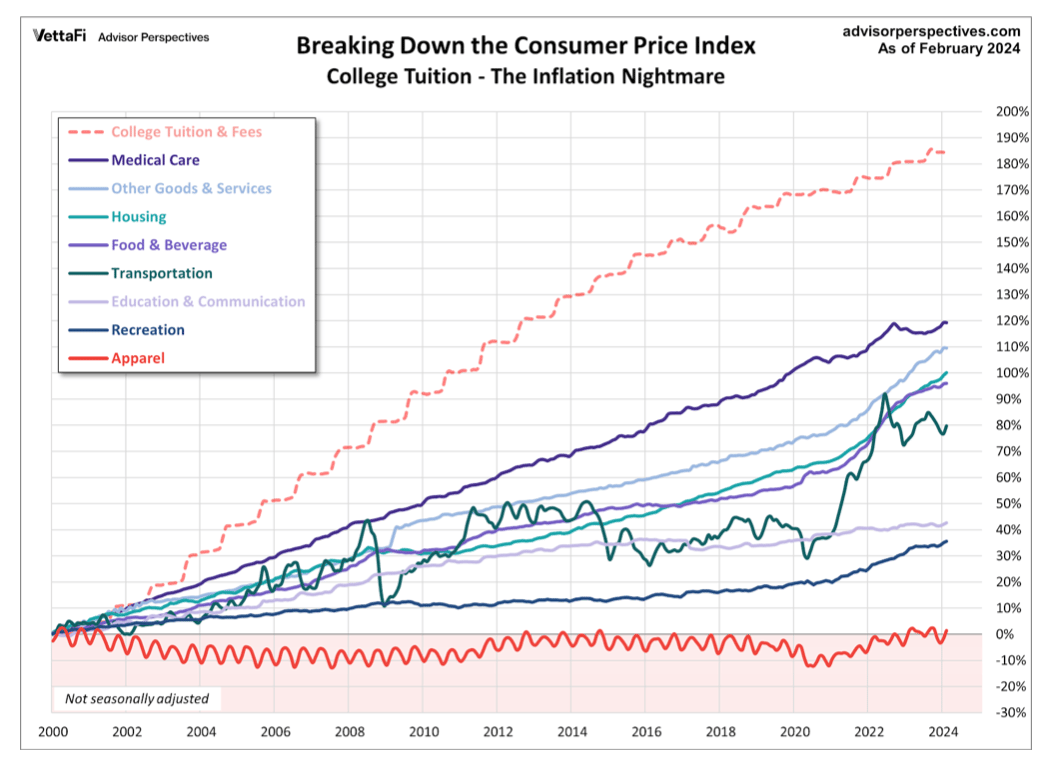

College costs? Yep, they're climbing too, every single year, right around back-to-school season. But here's a secret: the sticker price might scare you, but many families actually pay less thanks to financial aid and scholarships. So, it's not all doom and gloom!

College costs are rising the fastest

What does all this mean for you and me? Well, price hikes hit us differently. If you're driving a lot, a spike in gas prices can really hurt. If someone in your family needs a lot of medical care, those costs can add up fast. And if you're saving for college or paying off student loans, you know all about the tuition struggle.

Here’s Your Battle Plan To Defeat Inflation (and yes, its a war!)

Crafting a battle plan to conquer inflation requires a smart, forward-looking approach that caters to the needs and aspirations of Millennials, Generation Z, and HENRYs (High Earners, Not Rich Yet). Let's dive into a strategy that empowers these groups to not just survive but thrive in the face of rising price

1. Your armor in the battle is: Education & Awareness

The Foundation: Begin with financial literacy. Understanding the basics of inflation, interest rates, and how the economy operates is crucial. Utilize free online resources, webinars, and podcasts tailored to younger generations.

Stay Informed: Make it a habit to stay updated on current financial news and trends. Subscribe to newsletters and follow financial experts on social media who break down complex topics into digestible information.

2. Your weapons are: Investments in Real Assets

Real assets such as: real estate, commodities, and precious metals have historically outpaced inflation.

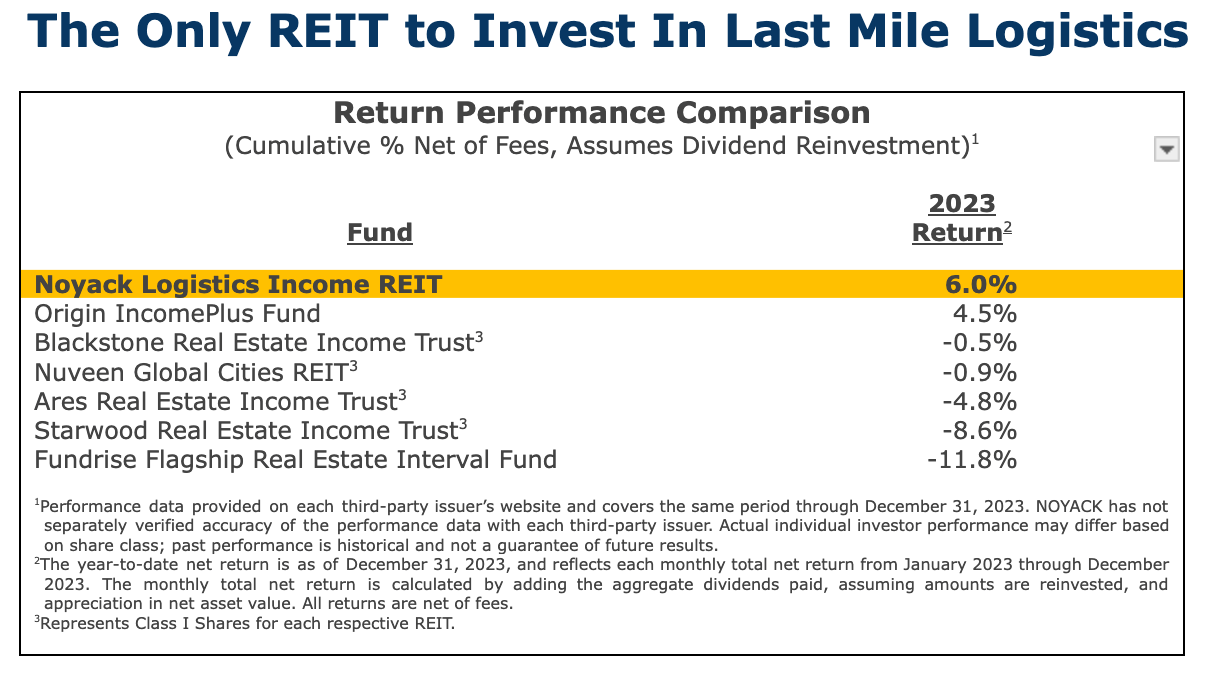

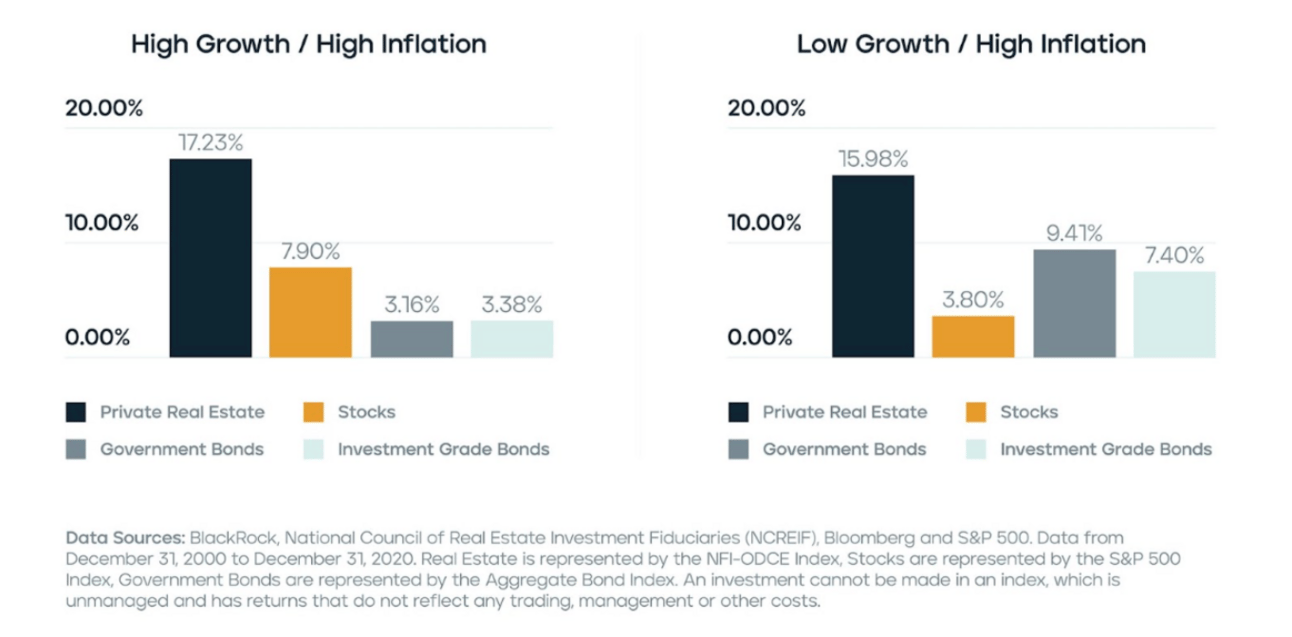

Real estate investment trusts (REITs), both public where the dividends can be lower, and private non traded REITS where the dividends are usually much higher, are more accessible options. Check out this comparison graph of asset classes during this period of inflation:

Include assets like gold and commodities in your portfolio. These are correlated hedge to inflation and rise with inflation because they are ‘fear’ assets and people get fearful when inflation sticks around. While we don't talk about Public Lee, traded stocks here at NOYACK, wealth, weekly (at least not yet), there are plenty of ETFs you can buy that give you exposure to gold and commodities like ticker symbols GLD, SLV or… PDBC for diversified commodities.

3. Your battlefield maneuvers are: Risk Management

Regularly rebalance your investments to protect yourself in uncertain times. Review and adjust your portfolio to maintain your desired level of risk, especially in volatile markets. Rebalancing is like adjusting the sails of your investment ship to stay on course in changing market conditions. By realigning your portfolio back to the course you originally set for your asset allocation, you manage risk and stick to your financial goals. This process is crucial in volatile markets to avoid excessive risk or being too conservative - both can hurt. It is a disciplined strategy to maintain your desired risk level, taking advantage of opportunities and securing gains without trying to time the market.

4. Your fortress is: Savings & Debt Management

Emergency Fund: An essential defense mechanism. Aim to save at least six months' worth of living expenses to weather unforeseen financial storms. Prioritize paying off high-interest debts. Consider refinancing options for existing loans to take advantage of lower interest rates, if available.

If your savings account doesn't offer you at least 4% interest on your money, then run for the hills. Or you can run to one of these 17 banks savings account that are FDIC insured that offer great interest bearing

5. Your long march is: Time horizon

“Time heals all ills.” Who said that? Well, it's true, and the key to inflation is to wait it out while taking steps to protect your net worth with our battle plan. Take advantage of compound interest by consistently investing over time, even small amounts. The earlier you start, the more you benefit. Patience is your ally; understand that building wealth is a marathon, not a sprint. Stay committed to your goals, adjusting strategies as needed but always keeping the long-term view in focus.

6. Get rid of your weakest link: Idle Cash

Keeping cash idle during inflation is like watching it slowly lose value. Inflation acts as a tax on your money's purchasing power, causing prices to rise and cash to buy less. For example, if inflation is at 3%, your cash loses 3% of its value each year. This means that $100 today could feel more like $97 next year in terms of purchasing power. Not investing or finding ways to grow your cash means losing money over time due to inflation.

Inflation-Protected securities like Treasury Inflation-Protected Securities (TIPS) can help protect against inflation. These bonds adjust their value based on changes in the Consumer Price Index (CPI), ensuring that your investment keeps up with inflation.

7. Gather your allies: Community & Support

Engage with communities of like-minded individuals who are also navigating their financial journeys. Sharing experiences and strategies can provide mutual support and new insights.

Seek Mentorship: Consider finding a mentor who has navigated similar paths successfully. Their guidance can be invaluable in avoiding common pitfalls and accelerating your financial growth.

This is how you BEAT inflation from beating you

How about Bitcoin as a the future hedge against inflation? Stay tuned 👉 next week we’ll explore the potential of Bitcoin as a hedge against inflation and its role in shaping the future of finance!

And for those who haven’t been paying attention … it just recently broke it's all-time high

Curated For You

STUFF TO DO WITH NOYACK

Read past editions here

Noyack Wealth Weekly is the leading wealth management newsletter published by CJ Follini & Noyack Wealth Club, a nonprofit dedicated to free financial literacy for younger generations. Feel free to tell us what you think of our little newsletter.