Est. Reading Time: 5 min

Table of Contents

‘Girl Math’ : A Journey Through Fashion as Investment 🛍️💰

Hey there, my fashion-forward friends! It's me, diving back into the whirlwind where fashion meets finance. As a self-proclaimed enthusiast caught up in the "girl math" trend, I've been pondering a question that's as stylish as it is financial: Can designer bags truly serve as investments? So, let's embark on this chic adventure together, shall we? 👜✨

Ladies (and many men!) can we talk? Are designer handbags really investments? First off, let's talk about the allure of those high-end, luxurious designer bags. They're more than just a fashion statement; they're a declaration of taste, personality, and sometimes, financial acumen. But as someone who's been navigating the intersection of glamour and gains, I've come to realize that the investment potential of designer bags is as layered as the latest runway looks. So, let’s dive in!

The ever-changing nature of fashion raises a crucial question: Will that trendy handbag still hold its allure a decade from now? The key factor appears to be the rarity and desirability of the piece. Yet, investing in designer handbags seems akin to taking a gamble, with no guaranteed returns. Unless your bag happens to be a limited-edition masterpiece, it may not quite fit the conventional definition of an investment.

CHANEL LIMITED EDITION PEARLY FLAP BAG 2019

Here's the scoop on what I've uncovered in my stylish sleuthing:

The Rarity Factor: Some bags are the unicorns of the fashion world 🦄 - rare, coveted, and with the potential to appreciate in value. But, let's be real, not every bag is a limited-edition masterpiece. Investing in designer handbags often feels like a glamorous gamble, with no guaranteed returns.

Middleman Markup: Imagine your bag's value skyrockets 🚀 - a dream come true, right? But here's the catch: selling it means dealing with auction houses or resale platforms that take a hefty cut (think 15% to 40%). Suddenly, your potential profit might just evaporate. 😬

Condition is King: A bag that's seen better days might be rich in memories but poor in resale value. Keeping your investment in mint condition is crucial, yet ironically, it means not getting to enjoy your stylish splurge as intended. 😅

The Authenticity Dance: Stepping into the resale game without proof of your bag's authenticity is like navigating a minefield. Every receipt and document becomes a treasure, adding an extra layer of hassle to your investment journey. 📄

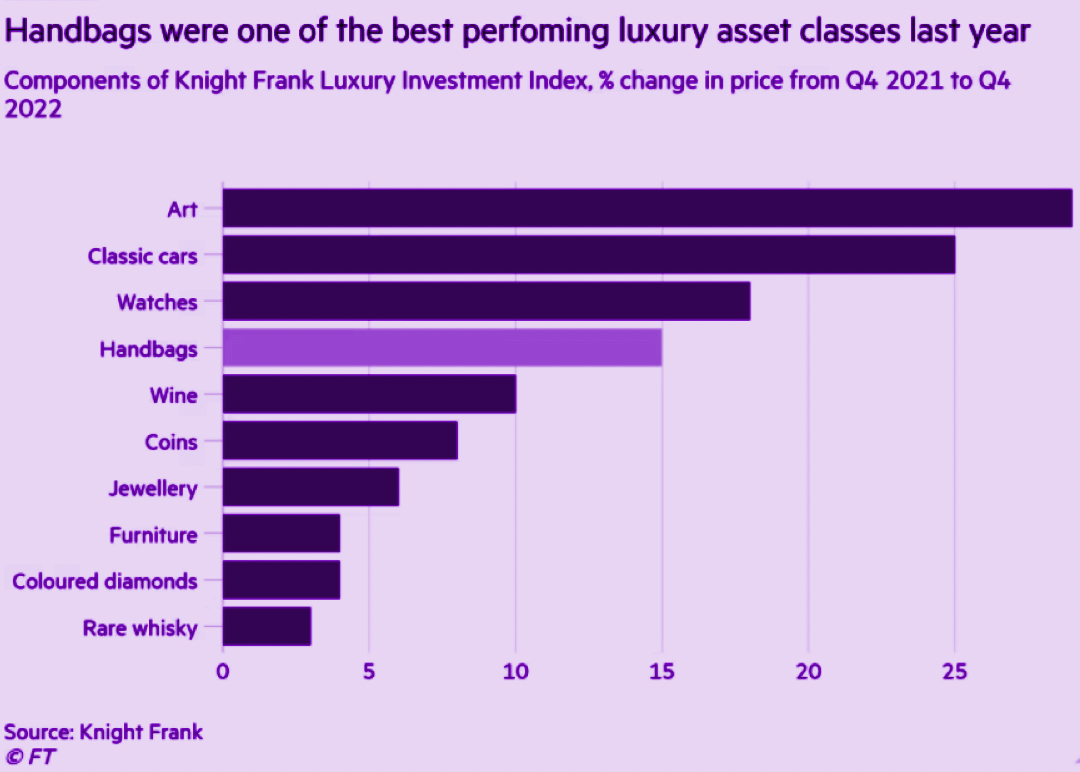

Beyond the Bags: Diversifying with a Dash of Luxury

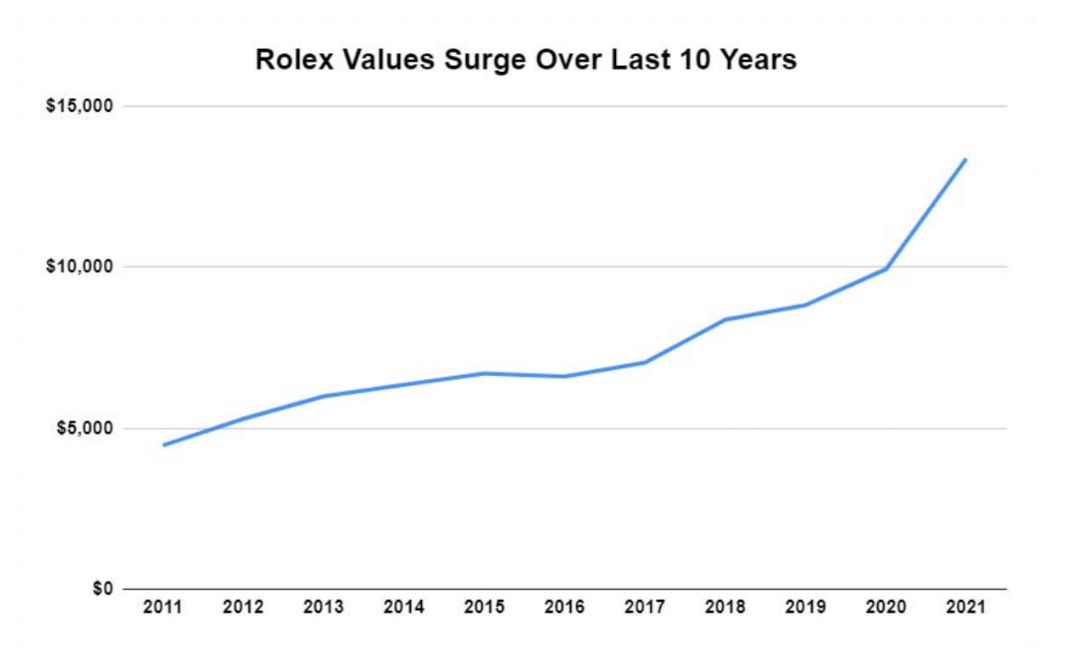

Now, as much as I adore my designer bags, I've started casting my gaze further afield. Why not explore the world of fine watches? Brands like Rolex and Patek Philippe aren't just symbols of sophistication; they're known for holding or even increasing in value over time. It's like having your cake and eating it too, but in the form of a stunning timepiece on your wrist. ⌚

The HENRY Dilemma: Seeking Growth Amidst Glamour

For us High Earners, Not Rich Yet (HENRYs), the quest for investment wisdom often involves juggling the allure of immediate gratification with the promise of long-term growth. Sure, splurging on that designer bag or luxury watch feels great now, but does it pave the way for financial prosperity? Here's where the blend of passion and prudence comes into play, urging us to consider investments that offer both immediate joy and potential future gains. So…

Got the time? What about the second best personal accessory - a timeless watch!

Alternative Investment Avenues: Instead of solely relying on the allure of a designer bag, consider diverting your attention to other high-value items like jewelry and watches. Brands such as Rolex

and Patek Philippe may require a substantial upfront investment (think at least $10,000), but their reputation for increasing in value over time adds an extra layer of financial appeal. Investing in these items transcends mere status symbols, offering a more substantial and potentially lucrative avenue for building wealth.

“Buying a vintage Rolex with a history of resale is like purchasing stock in a company like Amazon or Google,” Michael Blake, 29, said. “It is a blue chip. investment”

Amidst economic uncertainties, embracing fine watches as an investment could be a strategic move akin to diversifying with traditional safe-havens like gold or gems. Fine watches can establish themselves as enduring investments with intrinsic value, appealing to those seeking a balanced and lasting approach to wealth preservation and growth.

Source: Bob’s Watches

Coffee getting cold? Let’s bring this home with …

The Pros and Cons of Investing in Collectibles

Should we care about collectibles at all?

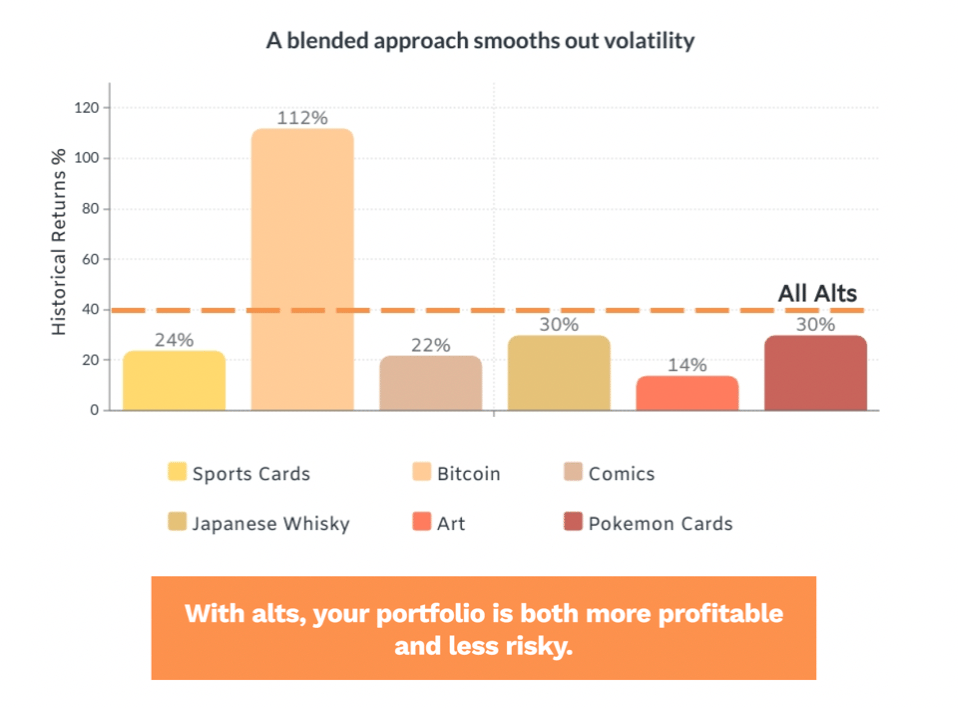

Maybe.. Perhaps the real worth of collectibles lies in diversifying your portfolio but relying solely on collectibles for investment could lead to a bumpy ride. These items are more than just assets; they're a reflection of you, your personal passions and convictions, blending investment potential with individual expression.

The Upside

1. Big Growth Potential: These silent growth warriors can seriously bulk up in value over time. For us HENRYs, with a bit more room to play the long game, they could end up being our financial home runs. 📈

2. Diversifying Like a Boss: Mixing these non-income-generating assets into our portfolios can help spread out risk. It's like not putting all our eggs in one basket, in case one of those baskets happens to fall off the financial counter. 🥚➡️📊

3. Tax Breaks for Days: Since these investments aren't throwing off cash regularly, they're not adding to our tax bill each year. For folks already in higher tax brackets, that's a pretty sweet deal. 💸

The Downside

1. Liquid What? These investments can be tough to convert back into cash quickly without losing value. That can be a real headache if we need to access our money sooner than expected. 💧➡️💰

2. The Waiting Game: If you're hoping your investments will help cover next year's vacation or a fancy new gadget, think again. These assets are all about the long haul, with benefits you'll see way down the line. ⏳

3. Roller Coaster Ride: With great potential comes great volatility. These investments can swing up and down, and their future value is anything but certain. It's like betting on the fashion trends of the next decade—exciting but unpredictable. 🎢

Finding the Sweet Spot

For High Earners, the path to wealth is through diversification! diversification! diversification! , blending growth with stability, especially with unique investments like collectibles. We aim for portfolios that reflect our lives and dreams, navigating the investment landscape together. Embracing our collective wisdom, let's explore alternative investments and celebrate our shared journey towards financial success. Cheers to growth! 🥂

Stay tuned for a future edition discussion on collectibles, from whiskey to wine and maybe even one about railroad ties (yes, I knew someone with a warehouse full of them…just because). That’s all for now, stay tuned folks!

Curated For You

These articles are a precursor to next week’s insights and opinions when I talk more about the massive consequences of the Great Wealth Transfer.

STUFF TO DO WITH NOYACK

Read past editions here

Noyack Wealth Weekly is the leading wealth management newsletter published by CJ Follini & Noyack Wealth Club, a nonprofit dedicated to free financial literacy for younger generations. Feel free to tell us what you think of our little newsletter.