Sunday, December 17, 2023

Table of Contents

Noyack Wealth Weekly is the #1 most subscribed newsletter about wealth management and alternative investments. NWW is published by CJ Follini & Noyack Wealth Club, a nonprofit dedicated to free financial literacy for younger generations.

This week's issue is not our regular format because it's our tradition at NOYACK to offer you a peek around the corner into 2024. Without further ado, here are CJ's Predictions for 2024 and the 10 Best Business Books we read in 2023.

CJ’s 2024 Predictions for the Self-Directed Investor

Prediction #1 - I predict that inflation and interest rates remain stubbornly high.

Factors indicate inflation is cooling: labor market rebalancing, potential wage growth slowdown, cooling job creation (1.3 job openings per unemployed worker) and U.S. housing prices show signs of slowing. However, I predict inflation will stabilize at a higher level due to industrial policy, energy transition, and global supply chain adjustments. So the Fed's mandate of 2% inflation will NOT be reached in 2024. This will limit their future toolkit to break the back of inflation further. Investors should consider real asset investments - real estate, fine art, to protect portfolios in this continuing economic cycle.

Prediction #2 - 2024 will be the year of Alternative Investments, aka 'Alts'

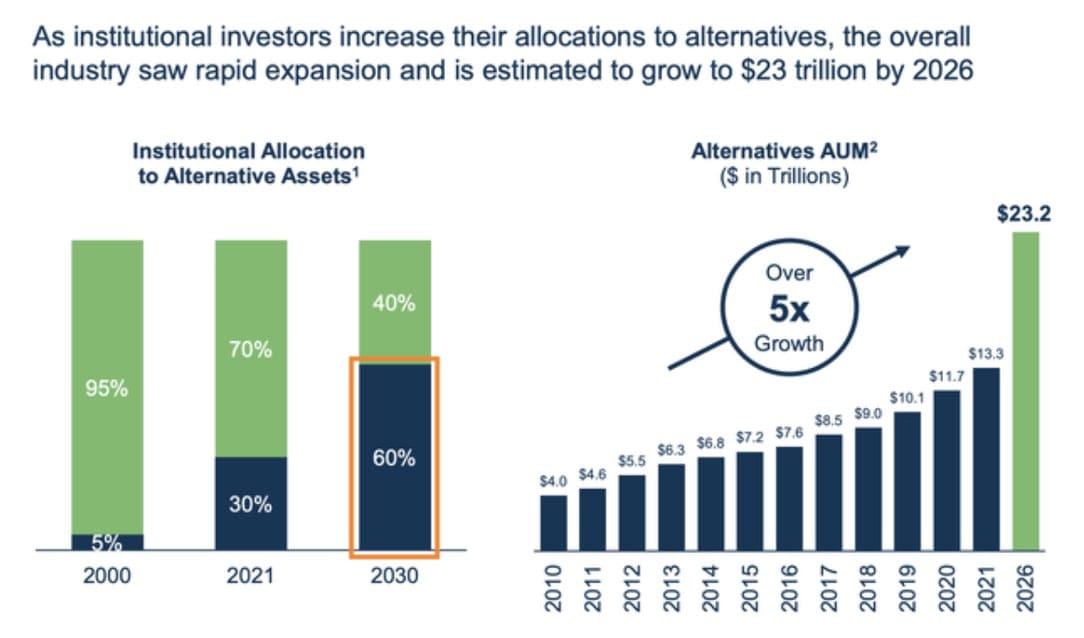

Millennials will lead the charge into alts and reducing their exposure to the public stock market. Why? Because millennials are one of the most risk averse generations in history and the current public markets have far too much volatility the last two months notwithstanding.

This means for the first time in history the average allocation to alternative investments for all individuals' investment portfolios will exceed 20%!

However, educating Millennials on the risks and rewards of these investments is crucial, emphasizing the importance of diversification and risk management.

Prediction #3 - 2024 will see the explosion of crowdfunding platforms in all asset classes

Equity crowdfunding, real estate crowdfunding, peer-to-peer lending, and royalty financing and more will become available to EVERY investor, accredited or not. I don't use the cliche democratization but... its true.

And here is a bonus prediction, call it 3A - residential real estate brokers will start equity shares in private investment offerings to their clientele for the first time ever.

However, investors must approach these options carefully, conducting thorough research and diversifying their portfolios wisely.

Prediction #4 - An AI-powered automated wealth manager will make their debut

As computing power and big data analytics continue to advance rapidly, we will see the launch of sophisticated robo-advisors that integrate alternative investments and tax optimization strategies alongside traditional portfolio allocation. This will expand access to highly customized wealth management for more investors. However, human financial advisors will still play a critical role, especially for high-net-worth individuals.

Prediction #5 - The rest of us say goodbye to the stock market

In 2024, I predict an historic low in retail investor participation in public stock markets is anticipated. This retreat reflects a growing distrust in traditional market mechanisms and a shift towards alternative investments I mentioned above. As retail investors step back, we may see increased market volatility and liquidity concerns, emphasizing the need for investor education and diversification strategies to navigate this new landscape.

Prediction #6 - The impending tsunami of maturing commercial real estate debt will cause a mini-crisis in the 2nd half of 2024

As 10-year loans, originated during the low-interest-rate environment of the early 2010s, start to mature, the specter of mass refinancing at markedly higher rates will loom large. This will force more property owners to sell, driving down valuations. Distressed commercial real estate debt may present opportunities for alternative investors, but caution is warranted.

Prediction #7 - The precipitous drop in corporate investment and persistently high interest rates will lead to stagflation

Barry Bannister from Stifel Nicolaus, renowned for accurately predicting the 2023 stock rally, presents a pessimistic outlook for the U.S. economy. He anticipates that with the Federal Reserve maintaining high interest rates to counter inflation, business spending will sharply decline, resulting in stagflation—a combination of low growth and high inflation.

This economic downturn is projected to impact diverse sectors, including housing, manufacturing, and retail. Stifel does not anticipate a rate cut from the U.S. central bank in the near future, highlighting the necessity for proactive fiscal stimulus measures alongside monetary tightening to address economic challenges.

Prediction #8 - 2024 is the year of the newsletter

Like one of my old hockey teammates said: "podcasts are like a$$holes...everyone's got one." There are too many and their impact is diluted.

Newsletters featuring specific subject matter expertise will surpass podcasts in popularity and educational impact.

In 2024, written newsletters will make a comeback as listeners seek focused, expert insights in finance, technology, health, and more. Writers with subject authority will build loyal subscriber bases, marking a return to depth and analysis after the dominance of shallow podcasts.

Prediction #9 - Robo-Advisors embrace alternative investment

In 2024, I predict that the robo-advisors like Robinhood, Ellevest, M1, and Betterment will embrace alternative investments, particularly in self-directed IRA accounts. This move will open up a whole new playground for everyday investors, providing access to things like private equity, real estate, and even exotic assets that were once out of reach. It's a game-changer, making high-end investment strategies more accessible to the average Joe and Jane, and shaking up the traditional retirement planning scene.

Prediction #10 - My beloved New York Rangers will win the NHL’s Stanley Cup in 2024!

General Manager Chris Drury is a massive winner. He has won everywhere ever since winning the Little League World Series in 1989.

10 Best Books of 2023

Unlock financial wisdom with our 10 Best Books of 2023! Dive into essential reads that offer timeless insights and diverse perspectives, catering to both seasoned investors and those embarking on their financial journey.

“Go to bed smarter than when you woke up.”

- RIP Charlie Munger

STUFF TO DO WITH NOYACK

Read past editions here

Noyack Wealth Weekly is the leading wealth management newsletter published by CJ Follini & Noyack Wealth Club, a nonprofit dedicated to free financial literacy for younger generations. Feel free to tell us what you think of our little newsletter.